Johnson & Johnson and Crucell Reach Agreement on Intended Public Offer of €24.75 per Ordinary Share of Crucell

Advertisement

Johnson & Johnson and Crucell N.V. announced an agreement whereby Johnson & Johnson, through an affiliate, would acquire all outstanding equity of Crucell that it does not already own for approximately € 1.75 billion in a recommended cash tender offer (the Offer).

After consummation of the Offer Johnson & Johnson expects to maintain Crucell's existing facilities, to retain Crucell's senior management and, generally, to maintain current employment levels. Johnson & Johnson also intends to keep Crucell as the center for vaccines within the Johnson & Johnson pharmaceutical group, and to maintain Crucell's headquarters in Leiden.

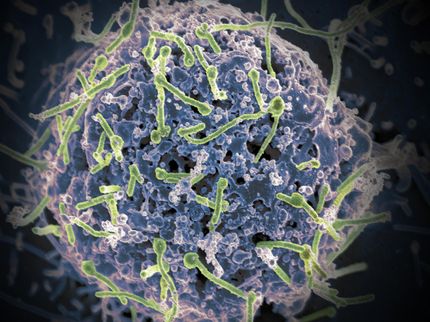

Johnson & Johnson currently owns 17.9% of Crucell's outstanding shares. In addition, in September 2009 Johnson & Johnson entered into an agreement with Crucell to develop a universal influenza monoclonal antibody and a universal flu vaccine for the treatment and prevention of influenza, as well as a long-term innovation collaboration for the development of monoclonal antibodies and/or vaccines directed against up to three other infectious and non-infectious disease targets.

Under the terms of the agreement, Johnson & Johnson, through a wholly-owned subsidiary, will initiate a recommended public offer under Dutch law to purchase all outstanding ordinary shares of Crucell not already owned by Johnson & Johnson and its affiliates for €24.75 per share (the Offer Price). The Offer Price assumes that, consistent with Crucell's prior practice and the terms of the merger agreement, no dividends will be declared and/or paid with respect to Crucell's ordinary shares. The financing of the Offer is not subject to third party conditions or contingencies.

The Supervisory Board and the Management Board of Crucell unanimously support the Offer, which represents a premium of 58% over the closing price of €15.70 as of September 16, 2010 and a premium of 63% over the 30 day average of €15.20 as of September 16, 2010. Both Boards believe the Offer is in the best interest of Crucell and its stakeholders including its shareholders, partners and employees, and unanimously recommend that Crucell's shareholders tender their shares into the Offer, when made, and to vote in favour of the resolutions to be proposed in connection with the Offer at the Extraordinary General Meeting of Shareholders (EGM) of Crucell to be held during the acceptance period of the Offer. The Board of Directors of Johnson & Johnson has also approved the transaction.

Upon closing, the transaction is expected to have a dilutive impact to Johnson & Johnson's 2011 earnings per share of approximately $0.03 - $0.05. The Offer Memorandum is expected to be published by the end of November 2010 and the transaction is expected to close in the first quarter of 2011.

Other news from the department business & finance

Most read news

More news from our other portals

See the theme worlds for related content

Topic world Antibodies

Antibodies are specialized molecules of our immune system that can specifically recognize and neutralize pathogens or foreign substances. Antibody research in biotech and pharma has recognized this natural defense potential and is working intensively to make it therapeutically useful. From monoclonal antibodies used against cancer or autoimmune diseases to antibody-drug conjugates that specifically transport drugs to disease cells - the possibilities are enormous

Topic world Antibodies

Antibodies are specialized molecules of our immune system that can specifically recognize and neutralize pathogens or foreign substances. Antibody research in biotech and pharma has recognized this natural defense potential and is working intensively to make it therapeutically useful. From monoclonal antibodies used against cancer or autoimmune diseases to antibody-drug conjugates that specifically transport drugs to disease cells - the possibilities are enormous