Battle for HIV drug market share getting fiercer - maybe too fierce for some

Advertisement

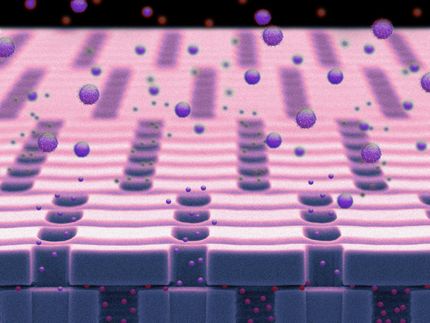

The HIV market, worth $9.3 billion in 2007, is expected to grow to $15.1 billion by 2017, driven by the increasing prevalence of HIV worldwide and the longer life expectancy of patients receiving treatment. Despite this growth, the competition is getting tougher across all antiretroviral drug classes. New efficacy and side-effect data on GlaxoSmithKline’s (GSK) nucleoside reverse transcriptase inhibitor (NRTI) fixed-dose combination Epzicom and results from two major trials on the use of protease inhibitors, will significantly change the dynamics within their respective classes. The first integrase inhibitor, Merck & Co’s Isentress, launched in the autumn of 2007, is further intensifying the competition. According to a new report by independent market analyst Datamonitor, competition is becoming so intense some big players in the HIV market may eventually be either squeezed, or opt out.

$15 billion market by 2017

In 2007, HIV drugs generated sales of $9.3 billion across the seven major markets (7MM), expanding with a compound annual growth rate (CAGR) of 11.3% (2004-2007). Over the next 10 years Datamonitor expects the market’s growth to slow down somewhat, but still reach total sales of $15.1 billion in 2017. Despite the increasing prevalence of HIV, factors such as the rising emphasis on cost containment, combined with patent expiries of key marketed drugs could inhibit future expansion. At the same time, newly launched drugs and drug classes and the greater number of patients accessing treatment will counteract these effects and contribute to the growth of the market. Patient numbers will rise predominantly because of an increased life expectancy, a steady number of new infections and immigration from areas of high prevalence to the 7MM.

Although the 7MM are commercially the most significant for HIV, they in fact only account for three to six percent of the globally infected population. HIV prevalence across the rest of the world is much higher, and access to antiretroviral therapy has been improving in low and middle-income countries. Thus, many pharmaceutical companies are turning towards fast-growing emerging markets as new sources of revenue growth. Among the former 7MM countries, Canada’s HIV market was worth $272 million in 2007, growing at a CAGR of 24% from 2004-2007. While larger than Japan’s, it remains smaller than any of the big five EU markets. Given Canada’s high HIV prevalence compared with Japan and reasonable price levels, Datamonitor believes there are significant opportunities within this market.

The battle for market share is getting fiercer

The HIV market is dominated by just a few companies. Gilead is the current market leader with a portfolio of four marketed products and an integrase inhibitor in late stage development, says Datamonitor infectious diseases analyst Mansi Shah. “The Californian biotech company’s NRTI fixed dose combination (FDC) Truvada remained the bestselling drug in 2007 with revenues of $1.5 billion, while Atripla, a novel cross-class fixed-dose combination brand only available in the US in 2007 generated sales of $920 million.

“Atripla, a joint venture between Gilead and Bristol-Myers Squibb (BMS), rapidly established itself as the new gold standard for newly diagnosed patients. By 2007 it was the fourth best selling HIV drug worldwide despite only being available in the US,” she says.

A changing of the guard?

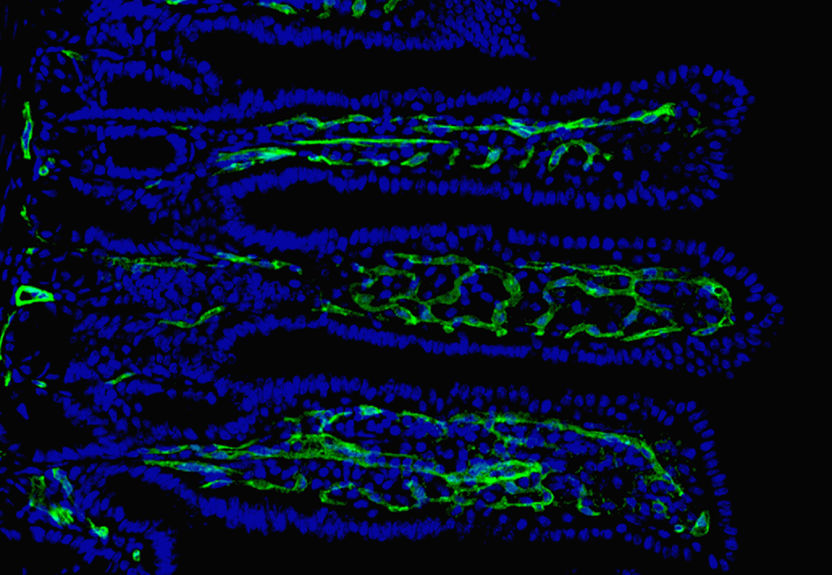

GSK, the market leader for much of the history of antiretroviral therapy, has eight marketed products, but many of its brands are relatively old and face patent expiration. In addition, several late-stage R&D setbacks over the past two years have left the company bereft of any HIV compounds in clinical development. The company had to face further problems this year when several independent studies highlighted that GSK’s main hope Epzicom, an FDC competing with Gilead’s Truvada, is both less efficacious in certain patients and associated with an increased risk of myocardial infarction, Ms. Shah says. “These data from the ACTG5202 and SMART trials and the D:A:D cohort come on top of the well known risk of hypersensitivity reactions to Epzicom’s abacavir component.”

The competition within the Protease Inhibitor (PI) class has also intensified. Two trials, the CASTLE and ARTEMIS studies, are largely responsible for changing the dynamics here. Kaletra, the previously undisputed leader has come out looking slightly, if not always statistically significantly, worse than the two newer challengers, BMS’s Reyataz and Tibotec /Johnson & Johnson’s Prezista. Although Kaletra continued to lead in the EU and Japan in terms of sales in 2007, Reyataz has been the number one in the US market for the last three years. Datamonitor expects the EU to favor Reyataz as well once it receives first line approval there, probably in 2009.

With no HIV candidates in the pipeline Abbott’s commitment to the sector beyond Kaletra and Norvir remains doubtful. By 2017, Datamonitor anticipates Reyataz and Prezista to become the leading PIs across the 7MM, pushing Kaletra out from leading to third PI. Despite Reyataz’s success, BMS’ overall franchise success is also at risk with Sustiva’s patent expiry in 2013, because the company has no visible follow-up compounds in development to make up for the shortfall. Tibotec on the other hand is in a better position thanks to two successfully approved products and one late stage candidate, likely strengthening its presence in HIV over the next 10 years.

In the space of just five months between September 2007 and January 2008, three new HIV drugs were approved by the regulators for the first time: Pfizer’s Selzentry, Merck & Co’s Isentress and Tibotec’s Intelence. Isentress and Intelence are already being widely used in highly active antiretroviral therapy (HAART) regimens for treatment experienced patients, but Selzentry’s launch has been very sluggish. Datamonitor has found that Intelence, a novel non-nucleoside reverse transcriptase inhibitor (NNRTI), is being used as early as second line therapy despite the lack of supporting data for this patient group. This off-label use risks cannibalizing the future franchise of Tibotec’s second NNRTI TMC278, which is targeted specifically at the treatment-naïve population this market, when launched around 2011.

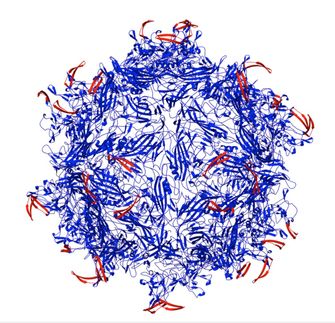

Building on Isentress’ efficacy and benign side-effect profile, Merck & Co. is pursuing approval for Isentress in the much larger early-stage and treatment-naïve patient population. Since traditionally a dual NRTI backbone in combination with either an NNRTI or a PI form the first line treatment, it is still unclear how integrase inhibitors drugs will fit in, Ms. Shah says. “Many different combinations are currently being investigated in various clinical trials. Given the optimism surrounding Isentress, integrase inhibitors have the potential to change first line regimens significantly over the next 10 years and really make a mark in this increasingly difficult market,” she says.