Expanding high risk population drives European hepatitis B and C diagnostics market, finds Frost & Sullivan

Low turnaround time and ease-of-use boosts use of rapid hepatitis assays in laboratories and point-of-care settings

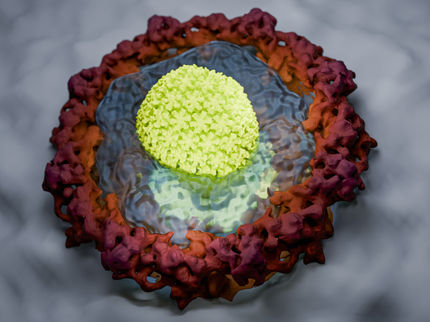

In recent years, the prevalence of hepatitis C has increased among high risk sub-group populations, including immigrants from areas where the disease is endemic, injecting drug users (IDUs) and patients co-infected with HIV.

“Overall, the incidence of hepatitis C among IDUs in Europe is estimated to be 96%”, notes Frost & Sullivan Senior Research Analyst K. Srinivas Sashidhar. “One third of people living with HIV/AIDS in Europe are thought to be co-infected with hepatitis C. This expanding population will boost the demand for hepatitis C testing, driving market growth.”

In contrast, the incidence rates of hepatitis B have fallen as most European countries have adopted universal vaccination programmes for the disease.

New analysis from Frost & Sullivan, Analysis of the European Hepatitis B and C Diagnostics Market, estimates revenues of the hepatitis B diagnostics to grow from $165.9 million in 2012 to $260.2 million in 2019 and hepatitis C diagnostics market to grow from $3,140.8 million in 2012 to $4,940.9 million in 2019, respectively. The research covers key trends in hepatitis B and hepatitis C diagnostics and their segments – nucleic acid testing (NAT) diagnostics and immunodiagnostics

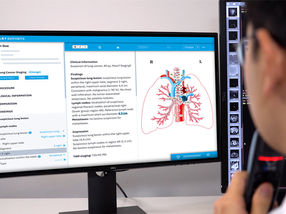

The low turnaround time and ease-of-use of rapid hepatitis assays in laboratories and point-of-care settings are also boosting market prospects.

“Rapid tests are compatible and easy to use as they do not require expensive instrumentation or testing by skilled personnel,” explains Sashidhar. “They produce results within one hour, exhibit more than 99% specificity and sensitivity ranges from 86–99%.”

However, the high costs incurred by laboratories in the routine performance of NAT diagnostics are affecting market revenues. While NAT diagnostics is considered to be effective, the need for sufficient skilled labour, expensive equipment and reagents and availability of fresh plasma/serum samples are likely to push laboratories to use serological immunoassays instead.

“Therefore, restructuring NAT marketing strategies to make them affordable for routine testing, along with continuous promotion of hepatitis screening programmes, is critical,” advises Sashidhar. “Another important requirement is to target high risk populations and develop effective diagnostics that clearly distinguish between acute and chronic hepatitis cases.”

Most read news

Organizations

Other news from the department business & finance

Get the life science industry in your inbox

From now on, don't miss a thing: Our newsletter for biotechnology, pharma and life sciences brings you up to date every Tuesday and Thursday. The latest industry news, product highlights and innovations - compact and easy to understand in your inbox. Researched by us so you don't have to.