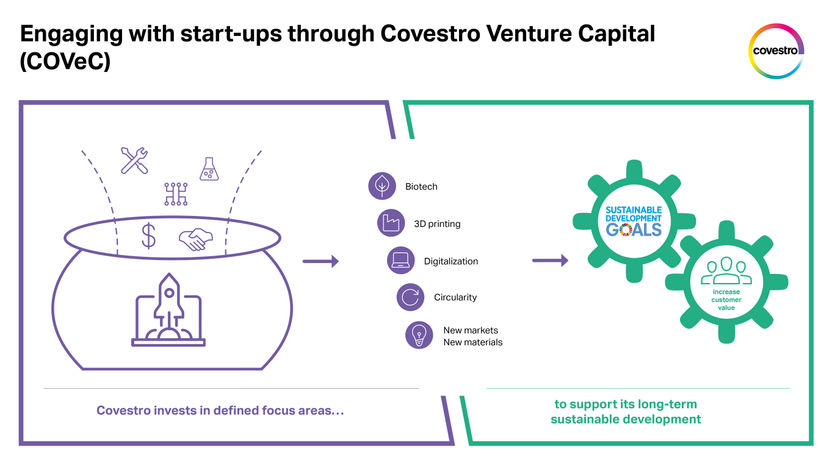

Covestro invests in start-ups

Five focus areas: Biotech, 3D printing, digitalization, circularity and new markets

Advertisement

Covestro is a start-up investor: With its Covestro Venture Capital (COVeC) approach, the company seeks to combine the needs of start-ups in areas such as financing, expertise and network with its own strategic goals with the goal of ensuring long-term sustainable development. “We are committed to sustainability-driven innovations. By working with young companies and their novel solutions, such as technologies, we are able to take the decisive step forward. This enables us to open up new business areas and provide innovative solutions that give our customers a competitive edge,” explains Sucheta Govil, Chief Commercial Officer (CCO) of Covestro.

Covestro

The most recent example: Covestro invests in the French technical start-up company Crime Science Technology (C.S.T). With this investment, Covestro strengthens its business with special films for ID documents and secures exclusive access to the Optical Variable Material (O.V.M®) technology for polycarbonate and polyurethane materials. This innovative technology developed by C.S.T enables new security features and makes identification documents even more forgery-proof than before.

Focus on established start-ups

Covestro's research and development (R&D) processes are always based on UN sustainability goals, which is why these goals also play an essential role in the selection of planned start-up investments. Consequently, five focus areas have been defined for COVeC to invest in: bio-based raw materials and biotechnology, additive manufacturing such as 3-D printing, circular economy, digital technologies, and new markets and technologies for existing core businesses.

In its selection of start-ups, Covestro primarily focuses on businesses in Series A and Series B financing rounds. “Our clear focus is set on scaling up businesses that are still young, but not entirely new. However, we are not ruling out any cooperations with start-ups at an earlier stage; for this we use our proven Open Innovation approach,” explains Dietrich Firnhaber, Head of Strategy and Portfolio Development at Covestro. Covestro intends to invest up to five million euros in initial financing rounds per project and, in individual cases, will participate in subsequent follow-up financing. The Board of Management must approve the financing project; there are no plans to set up a stand-alone fund for the venture activities.

Covestro made its first venture capital investment last year and took a stake in the German start-up Hydrogenious LOHC Technologies GmbH as part of a Series B financing round. Together with the young venture, Covestro plans to actively promote the development of an international infrastructure for hydrogen as an alternative source of energy.

Other news from the department business & finance

Most read news

More news from our other portals

Something is happening in the life science industry ...

This is what true pioneering spirit looks like: Plenty of innovative start-ups are bringing fresh ideas, lifeblood and entrepreneurial spirit to change tomorrow's world for the better. Immerse yourself in the world of these young companies and take the opportunity to get in touch with the founders.