SYGNIS AG acquires US life sciences tools company

Advertisement

SYGNIS AG announced the execution of a binding agreement for the acquisition of C.B.S. Scientific Company Inc. (C.B.S.), a Life Sciences tools company located in San Diego, USA.

SYGNIS will pay a total consideration of $900,000 of which $540,000 is in cash, funded from existing cash balances and $360,000 in the form of 275,311 new shares in SYGNIS AG to be issued from authorized capital. Five-sixths (5/6) of the shares issued to C.B.S stock holders will be restricted from trading for six months from the date of the registration of the excecution of the respective capital increase. After this period of time, with the beginning of every month, one-sixth (1/6) of the new shares shall be released from the aforementioned lock-up rule.

The acquisition of C.B.S. is anticipated to be earnings enhancing and cash generative from the onset. Current revenues are in excess of $1,500,000 p.a. and the strong synergies between the C.B.S. and SYGNIS product portfolios, plus the sales and customer base provide a clear opportunity for solid post acquisition revenue growth. Combining the Expedeon business location in San Diego and C.B.S. will allow additional cost savings.

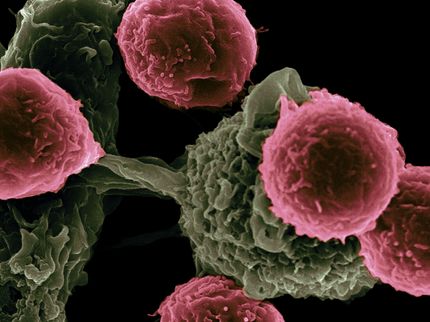

C.B.S. has developed a strong global brand in electrophoresis equipment and scientific instrumentation for genomics and proteomics research. The company’s product offering is highly complementary to SYGNIS’ product ranges and includes a wide variety of electrophoresis systems as well as DNA mutation detection systems and DNA workstations to provide a contaminant free environment for DNA amplification.

Dr. Heikki Lanckriet, Co-CEO and CSO of SYGNIS, said: “Following on from the successful integration of Expedeon into the SYGNIS Group, this new acquisition further strengthens SYGNIS’ presence in the North American market, particularly in California. Furthermore the strong brand associated with the C.B.S. products will solidify our position as a global supplier in the Life Sciences and reagents market. With the addition of complementary product lines, SYGNIS now aims to cover its core genomic and proteomic workflows more comprehensively. The additional sales channels provide the Group with enhanced revenue generating potential. The combination of strong organic growth with complementary acquisitive growth provides a very strong basis for SYGNIS’ ultimate goal to become the leading Life Sciences tools and reagents company.”

Pilar de la Huerta, Co-CEO and CFO of SYGNIS, added: “This is an excellent acquisition for SYGNIS. C.B.S. is a profitable company, with a very stable and highly complementary customer base. Due to the successful capital increase in July 2016, SYGNIS is able to fund

this acquisition with a minimal dilutive impact for our current shareholders. Next to the superb strategic fit, this acquisition also aids our drive to achieve ambitious financial goals.”