Record investment: Tubulis Raises landmark €308 Million Series C

USD 361 million round represents the largest Series C for a European biotechnology company and the largest financing for a private ADC developer globally

Advertisement

Tubulis announced the successful closing of a €308 million (USD 361 million) financing. The round was led by Venrock Healthcare Capital Partners with participation from additional new investors Wellington Management and Ascenta Capital. Existing investors who supported the Series C include Nextech Invest, EQT Life Sciences, Frazier Life Sciences, Andera Partners, Deep Track Capital, Bayern Kapital, Fund+, High-Tech Gründerfonds (HTGF), OCCIDENT, and Seventure Partners.

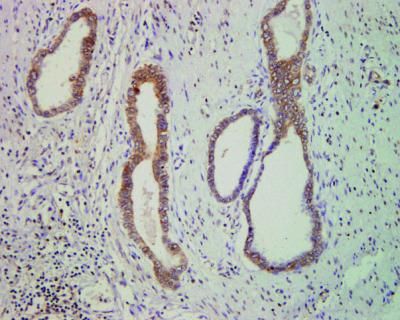

The proceeds from the Series C financing will be used to expand the clinical development of TUB-040, Tubulis’ lead antibody-drug conjugate (ADC) candidate, into earlier lines of therapy and additional tumor indications. TUB-040 targets NaPi2b, an antigen that is overexpressed in ovarian cancer and lung adenocarcinomas. TUB-040 is currently being evaluated in a Phase I/IIa study (NAPISTAR1-01, NCT06303505) in patients with platinum-resistant ovarian cancer (PROC) as well as relapsed or refractory non-small cell lung cancer and was granted Fast Track designation by the U.S. FDA in June 2024. The capital will also advance Tubulis’ pipeline, including the clinical-stage ADC candidate TUB-030, several preclinical programs, and expand its proprietary ADC platform technologies to bring ADCs into novel applications.

Superior therapeutic value to patients

“This landmark financing round reflects the deep conviction these global healthcare investors have in Tubulis and the disruptive potential of our ADC platforms,” said Dr. Dominik Schumacher, CEO and Co-founder of Tubulis. “With TUB-040 progressing in the clinic and first data to be shared in a late-breaking oral presentation at ESMO, we are ready to expand into earlier treatment lines, while continuing to innovate across our pipeline and technology platforms. The new funding empowers us to execute on our vision of creating truly differentiated antibody-drug conjugates that are tailored to the biology of solid tumors and can deliver superior therapeutic value to patients.”

“Tubulis has distinguished itself in the ADC field with a forward-looking vision consistently backed by strong scientific data,” said Nimish Shah, Partner at Venrock Healthcare Capital Partners. “The company is now positioned to translate an exceptional preclinical foundation into meaningful clinical results, with several important readouts on the horizon. As Tubulis continues to expand its pipeline and build momentum, I’m excited to partner with the leadership team and Board to advance a new generation of ADC medicines for patients.”

A testament to the scientific strength of the Tubulis team

In conjunction with the financing, Dr. Lorence Kim, Co-founder and Managing Partner at Ascenta Capital and Patrick Heron, Managing Partner at Frazier Life Sciences, will join Tubulis’ Supervisory Board. An overview of all Supervisory Board members and their biographies can be found here. “This milestone financing is a testament to the scientific strength and executional track-record of the Tubulis team,” added Dr. Christian Grøndahl, Chair of the Supervisory Board of Tubulis. “The company has built a unique ADC platform and is now working on demonstrating its clinical impact. With the backing of experienced biotech investors, Tubulis is on a path towards solidifying its position as a global leader in the ADC landscape.”

Other news from the department business & finance

Most read news

More news from our other portals

Something is happening in the life science industry ...

This is what true pioneering spirit looks like: Plenty of innovative start-ups are bringing fresh ideas, lifeblood and entrepreneurial spirit to change tomorrow's world for the better. Immerse yourself in the world of these young companies and take the opportunity to get in touch with the founders.