Demand for hybrid solutions to spur European interventional radiology and cardiology markets, finds Frost & Sullivan

Sustained revenue generation will depend on designing customised, user-friendly, integrated offerings

The European market for interventional radiology and cardiology is heading towards maturity, especially in Western Europe. Although the economic slowdown and fewer orders had a negative impact on revenues in 2012, it is expected that expanding applications of interventional systems and the popularisation of hybrid solutions will drive market growth over the 2013-2017 period.

New analysis from Frost & Sullivan, Market Trends in Europe Interventional Radiology and Cardiology, finds that the market earned approximately $336.7 million in 2012 and estimates this to reach $352.6 million in 2016. Novel applications, the demand for hybrid solutions and the need for new systems in Eastern Europe will fuel market growth.

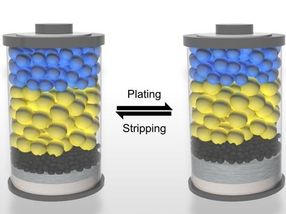

One of the key trends in medicine is the steady replacement of open surgeries with minimally invasive procedures. Hybrid operating rooms support this trend.

“The expansion of minimally invasive procedures and hybrid operating rooms are set to galvanise the interventional radiology and cardiology markets,” notes Frost & Sullivan’s Healthcare Industry Analyst Dominika Grzywinska. “Minimally invasive procedures are becoming increasingly popular, among both patients and healthcare providers. This has spurred the demand for hybrid operating rooms accommodating interventional systems.”

Hybrid systems combine operating room equipment with large diagnostic units and can be used by a variety of medical specialties. A mid-term obstacle could potentially be the high cost of such hybrid solutions. Nevertheless, an increasing number of healthcare facilities are investing in such models, as they offer a significant competitive advantage, and with appropriate throughput, a positive return on investment.

The economic slump had a strong impact on revenues in 2012, particularly in the more mature markets of Western Europe, such as Italy and Spain. Confronted by economic uncertainty, many facilities decided to put their investments on hold, contributing to lower revenue generation.

“With approaching market saturation, especially in Western Europe, end users are increasingly interested in user-friendly, integrated solutions,” concludes Grzywinska. “Vendors need to offer customised solutions that meet the specific needs of end-users, rather than providing standard, ready-to-use ones.”

Most read news

Other news from the department business & finance

Get the life science industry in your inbox

From now on, don't miss a thing: Our newsletter for biotechnology, pharma and life sciences brings you up to date every Tuesday and Thursday. The latest industry news, product highlights and innovations - compact and easy to understand in your inbox. Researched by us so you don't have to.